These days, a brand can ‘emerge’ at a moment’s notice — creating a basic website, checkout and payment system, and social media presence from anywhere at anytime.

So what is an emerging brand, and why do 70% of CPG product launches fail?

Some brands grow too fast without knowledge and resources to sustain themselves, while others don’t fully capitalize on CPG marketing opportunities to win at the shelf.

“The big concern is putting something on the shelf and expecting it to move,” said Tate Glasgow, VP of Marketing at Killer Creamery. “That is not how our world works — and it is also not what your buyer expects you to do. Before you take on that new account make sure you have the funds to properly and aggressively promote [your products.]”

While direct-to-consumer brands are here to stay, achieving in-store product discovery should be part of any shopper marketing strategy to ensure successful retail performance — especially since the majority of $250B+ natural product sales occur at brick and mortar grocery stores. This dynamic can create a major challenge for emerging brands.

Emerging brands need to act quickly but thoughtfully to meet shoppers in the right place at the right time, while satisfying and growing retail partnerships. To do that, it’s important to narrow in on what type of emerging brand you are and what your focus should be as you learn and grow.

Emerging brands tend to start selling products in the natural channel before scaling into conventional. The move into the conventional channel often starts region by region with high pressure new listing tests, aiming to bring customers to the shelf and win the coveted national distribution.

Each stage of an emerging brand has a unique set of challenges and needs.

1. Early Stage

Target channels: Natural retailers like Whole Foods Market and regional independent retailers

Goal: Prove traction in natural channels and smaller retailers, gaining strong data to support product-market fit to eventually expand into the conventional channel.

Tips:

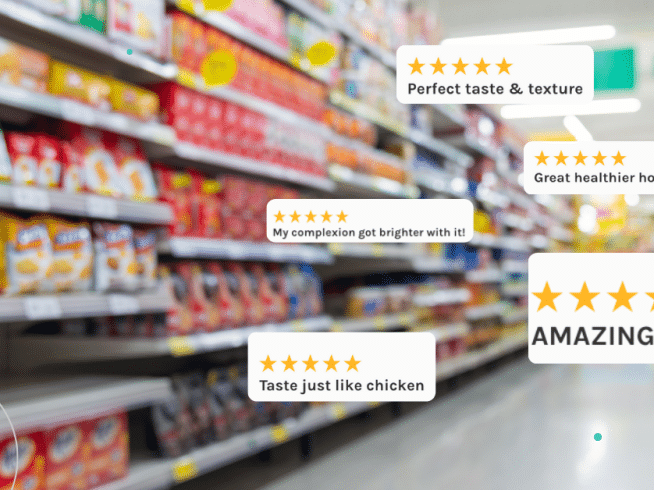

- Focus on driving in-store discovery to ensure your products are noticed and selected off the shelf.

- Start with a small assortment that you can keep fully stocked.

- Invest in an eye-catching packaging design early to avoid expensive rebrands later.

- Collect consumer insights to validate product-market fit, refine your target audience, and prepare for scale. Find out what retail shoppers are really thinking.

- Use POS data, product reviews, and ratings to build case studies to support expanding your retail footprint and raising capital.

Example:

Clean sausage brand Seemore Meats & Veggies launched two weeks before pandemic lockdowns in March 2020. Two years later, the brand fired up a sizzling shopper marketing strategy to drive trial, awareness, and gain valuable consumer insights.

To do that, the company used digital sampling at Whole Foods to collect 1,800 product reviews, crucial ratings, and email opt-ins. The strategy helped boost their website’s SEO, growing e-commerce sales $100,000 year-over-year.

The company found their core consumers mostly shop at Sprouts and Target, which helped land commitments with those key retailers. They also used customer feedback to improve their packaging, better highlighting attributes like ‘Made with all-natural chicken’ and ‘No added nitrates or nitrites’ that make the brand stand out from its peers.

“Getting real consumer feedback to make product and website adjustments has been crucial,” Tracy Lowy, Seemore’s Marketing Director, said. “We have begun to understand on a deeper level what type of consumer is most interested in our sausages.”

2. High Growth

Target channels: Natural channel and scaling into conventional

Goal: Maintain growth in the natural channel and succeed in regional conventional banner tests to secure national distribution.

Tips:

- Big box merchandising environments can be tough for small brands. Focus your dollars on driving traffic right to the shelf, and do your best to collect store-level insights to pinpoint any issues consumers have finding your products in-store.

- Think digital first. Traditional marketing typically won’t drive shelf-turns during tests as it tends to move too slowly: you’ll need proven digital strategies that get the right customers to the shelf quickly. Digital sampling can be a good option to enable targeted trial at the store level using focused offers.

- Listing fees are costly, preserve enough funds to drive sell through after paying store fees.

- Keep enough working capital ready to fulfill large purchase orders. Things will start to move quickly if your regional banner tests succeed and you gain national distribution.

- Conventional stores have different margin expectations. Know your margins and ensure you have strong supplier relationships ready to support your growth.

- Have an innovation pipeline ready to discuss with buyers as they ask about your growth plans.

Example:

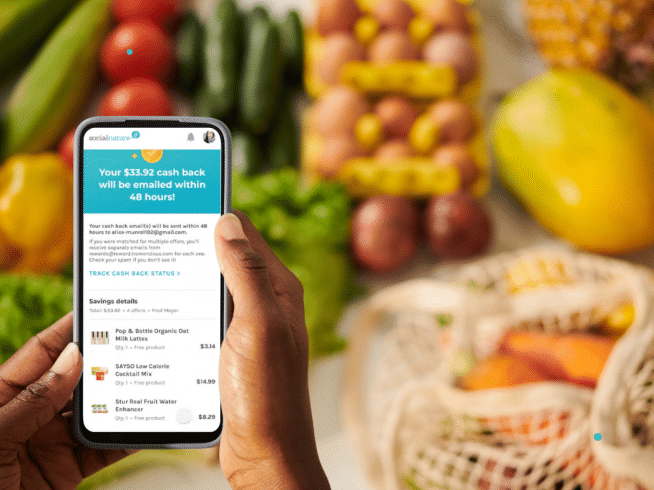

Better-for-you pasta brand Veggiecraft Farms needed to to increase brand awareness, drive trial, and obtain consumer insights at Walmart. Through its digital sampling campaign, the brand took Walmart shoppers through a full purchase journey.

Qualified customers received a free product voucher to redeem at Walmart. As a result of the campaign, Veggiecraft Farms received over 4,000 product reviews with an average product rating of 4.3/5 stars. Additionally, 32% of customers who sampled the product opted in to receive emails with updates and offers in the future.

The sampling campaign helped Veggiecraft Farms increase unit velocity and repeat purchases, while key insights and data supported product conversations with buyers. Overall, 49% of customers who tried the brand bought it again within three months, and 38% replaced their go-to pasta brand with Veggiecraft Farms.

“We’re gaining a lot of insightful information about our ideal customer as well as how those who may have never heard of us feel about our product in real-time,” said Kate Nees, Brand Manager at Veggiecraft Farms.

3. National

Target channels: National distribution in natural, conventional, and club channels

Goal: Increase household penetration, market share, and prepare for exit, usually a strategic acquisition.

Tips:

Once you’ve gained national distribution, it’s time to maintain and block shelf space.

- Launch new innovations to expand the set, ideally securing multiple placements in stores.

- Invest in national brand awareness efforts as part of your shopper marketing strategy to support sales across multiple retail channels.

- Identify key regional markets, and double down spending there to maximize sales where the upside is greatest.

- Discontinue underperforming SKUs, and focus on top-selling hero products to keep building market share.

- Leverage direct consumer relationships for crowdsourcing new innovation concepts and supporting product launches.

Example:

Primal Kitchen needed a fresh way to reach new buyers to drive trial and engagement on new items and core products. Finding a way to measure purchase intent and generate feedback was crucial for the brand.

Since working with Social Nature, Primal Kitchen has completed over 25 digital sampling campaigns in the U.S. and Canada in Kroger, Walmart, Sprouts, Whole Foods, and other natural channels. Each campaign had customized criteria by:

- Retailer(s)

- Shoppers interests

- Shoppers dietary preferences

- How often a shopper purchases a particular category

Digital sampling resulted in positive retailer scorecards, a deeper understanding of the brand’s consumers, and repeat D2C purchases.

By prioritizing a strong shopper marketing strategy, Primal Kitchen generated over 2,100 reviews for three SKUs within three months. Plus, the brand discovered ways to reposition its products, update product names, cross-sell, and better understand various regions.

“The data is a game-changer for rethinking our strategy for sampling. A new benchmark has been set,” said Kelly Meredith, Shopper Marketing Manager at Primal Kitchen.

While the sampling campaigns’ primary objective is to drive targeted trial at retail, Primal Kitchen also offered a 25% off discount code to be redeemed on their website. This brought 687 consumers online to shop after sampling, generating over $32,000 in D2C sales. Additionally, 36% of consumers who sampled opted in to Primal Kitchen’s mailing list for ongoing re-engagement.

For emerging brands, it’s critical to focus on driving trial and discovery in stores. That means keeping your priorities in check as you navigate various growth stages.

Products sitting on a shelf unnoticed won’t help the brand grow: emerging brands have to earn the right to shelf space — and hopefully expand beyond it. That’s why shopper marketing is crucial to emerging brands’ growth.

Many shoppers start their journey of discovery online, and then buy the products in stores. As a result, emerging brands should create a robust online-to-offline (O2O) shopper marketing strategy, to drive customers to the shelf and keep them engaged.

To build strong retailer and investor relationships, emerging brands also must continue validating products with ongoing shopper data to support expansion opportunities. Drop low-performing products and use direct consumer feedback to decide on your next innovation strategies.

Digital sampling drives predictable in-store discovery, acquire new shoppers, and gain important data to support scaling emerging brands sustainably.