1. In-store demos

Classic in-store demos are great for face-to-face feedback and close proximity to the point of purchase.

However, there are a variety of challenges. These demos often aren’t targeted, relying instead on unpredictable in-store traffic. Additionally, it can be hard to aggregate consumer feedback this way, as many shoppers will just grab and go.

Another potential issue is training demo staff to maintain consistent messaging. These demos can also be hard to scale efficiently. All of this can amount to a costly, labor-intensive strategy.“The educational experience is really important in the sales process,” Malach noted.

Best for:

Early stage natural brands with small founding teams who can execute the demos. Telling the brand’s story and connecting with customers is crucial.

2. Digital Demos

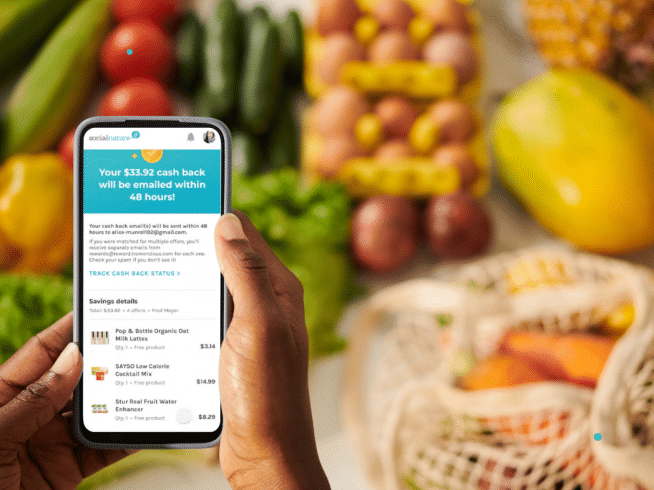

Social Nature pioneered Digital Demos six years ago, and the idea accelerated during the pandemic.

Its future looks bright as well. This method allows for better targeting, boosts online engagement, and delivers direct product feedback, helping CPG brands seamlessly grow their audience and offerings.

Consumers love knowing the story and ingredients behind brands before they spend money on them. Digital sampling is a great way to do that: brands can encourage sales by providing in-store (or direct-to-home) coupons for full-size products along with their samples.

Additionally, customers are encouraged to share user-generated content and feedback, further amplifying the brand online. This can deliver engagement rates up to 60-80%, Malach said.

“Digital product sampling can generate extremely high engagement rates because you’re getting people to opt in in the first place, and they get educated about the products before they try them and get to hear the right key messaging,” she explained. “It’s an effective way to do shopper marketing — and get a lot more data while you do it.”

Though offering a free full-size product at retail can be expensive for brands, the data gained in return is invaluable, Malach noted. It also helps build retailer relationships.

Knowing how to use a digital sampling strategy will continue to be important for emerging brands.

“It’s super effective and a really necessary strategy for early stage companies to make sure they start to get the sales lift they need to stay on the shelf,” Malach said.

Best for:

Emerging brands seeking awareness and in-store traction, especially those with hard to sample items like perishables and frozen foods. It can be harder for larger brands ($100M+) to scale free product digital sampling, so offering BOGOs and other special offers can be a fruitful strategy for driving trial at retail for these brands.

3. Field marketing

Though it may have dwindled during the pandemic, field marketing is back on the upswing. This strategy can help build community in key geographic regions, Malach said, helping brands reach their target audiences and garner personal feedback. Brands should consider basing these efforts near retailers that sell their products, she added.

This method can require a lot of coordination and be difficult and expensive to scale. It also can be challenging to translate into useful data.

To promote engagement, brands can leverage QR codes with a call-to-action encouraging customers to write a review or follow the brand on social media.

Best for:

Brands with established distribution and traction at retailers, especially experiential, easy-to-prepare items like beverages and powdered drink mixes.

4. Sampling boxes

Sampling boxes can be ideal for mass campaigns. This method can also be more affordable, with shipping costs split between multiple brands.

Additionally, brands may find paid opportunities for submitting their products to sampling boxes, such as subscription beauty boxes.

Still, a brand may find that consumers are more interested in the variety of products rather than focusing on one product alone. How will your brand stand out? Brands may want to include a promo code or coupon to encourage purchases.

Best for:

Works best in subscriber programs, especially for beauty and skin care products. This method is less effective for grocery products.

5. Direct mail

Though it might seem “old-school,” direct mail is still a channel that can be effective, Malach said. In part, that’s because brands generally do it less, which means less competition.

For this method, brands will need strong creative assets and a clear call-to-action for customers to buy online and help build the brand community.

Offering a sample that’s a sufficient size (e.g. more than a tablespoon of ketchup) is important, Malach noted. Make sure the products fit FDA requirements as well.

This can be a great method for geotargeting by zip code and reaching older demographics, she added. However, conversion rates may be lower, and this method can be expensive to execute. Additionally, some people barely check their physical mail, so there may be lags in activity.

Best for:

Brands that want to geotarget a specific area and/or reach older demographics

6. Grocery delivery sampling

Sampling along with retailer deliveries can be a great way to get customers’ attention. Since the customer immediately knows where your product is sold, it’s easy for them to jump online and buy it or add it to their next cart. You can partner with retailers to offer a promotion or include a QR code to promote engagement and feedback.

Still, there can be setbacks. For example, many people have auto-reorders set up for grocery deliveries. Also, this method can see lower conversion rates since customer’s didn’t opt in for receiving samples. It can be expensive, and you may not receive product feedback.

Make sure the brand mission is clear through your messaging, and again, provide a sufficiently-sized sample.

“It’s important that they can use the product in a full serving or cook with it and experience it so it becomes a habit, and be sure to prompt them to add the product to their order list online!” Malach noted.

Best for:

Brands that want to strengthen 3rd party online retailer partnerships.

7. PR & influencer marketing

PR and influencer marketing is often ideal for direct-to-consumer (D2C) brands, helping them align with creators who have access to their target audience. This is useful for getting user-generated content and driving traffic. With a solid campaign as part of a larger marketing strategy, brands can create strong brand awareness.

However, not every brand has dedicated support for ongoing influencer initiatives. Also, you may not get direct feedback from influencers, and you should be strategic in choosing them.

An influencer’s follower count alone doesn’t tell the full story. Microinfluencers can often have a bigger, longer-lasting impact.

Make sure it feels like a good fit first (their brand and audience is aligned with yours) and look at their engagement rates: how many people are liking or commenting divided by total followers. Engagement rates for microinfluencers hover around 10%.

Influencer rates can range from $500/post – $15,000/post. Be mindful of your larger marketing budget when implementing this method.

Best for:

- Supporting DTC e-commerce through affiliate links

- Creating social buzz if multiple creators promote in a short time frame

- Longer term partnerships where the influencer is integrated into your brand strategy

1. What are some of the most effective product sampling strategies?

Product sampling is a great way to drive sales and spread awareness of your CPG brand. The most common product sampling strategies include providing free samples in-store, online, or at events; creating influencer collaborations that involve product giveaways and reviews; or taking part in subscription box programs. Each strategy has its own set of advantages and considerations, so it’s important to evaluate which one fits best with your budget and goals.

2. How can I ensure that my product sampling campaign will be successful?

The key to success when running a product sampling campaign is ensuring that you target the right audience for your product. Identifying which channels and potential customers are more likely to engage with your brand can help you create an effective campaign that drives more sales. Additionally, you should also consider measuring ROI metrics such as customer acquisition rate, average order value (AOV), repeat purchases, etc., to get a sense of how effective the strategy is.

3. What factors should I take into account when planning a product sampling budget?

When setting up a budget for product sampling campaigns, consider the following: cost per sample including shipping; cost per branding materials; total number of samples needed based on estimated number of target customers; estimated cost per conversion (CPC); cost of influencer collaboration (if applicable); and other associated costs such as promotions or advertising fees.

4. What are some tips for creating an engaging experience for potential customers?

Creating an engaging experience for potential customers through product sampling campaigns involves understanding their needs and expectations from the start—from choosing the right products to showcasing them in a way that speaks directly to them.

It’s important to focus on customer service since this will help build trust with prospects who may not be familiar with your brand yet—for instance by making sure all customer questions are answered promptly or providing helpful advice related to usage or storage options for the sample products if needed.

Don’t forget about incentivizing customers with discounts or freebies after they’ve sampled your products—this will encourage them to come back for more!

5. What type of data should I collect when running a product sampling campaign?

Data collected during a product sampling campaign can provide valuable insight into consumer behaviour and preferences, allowing brands to better tailor future campaigns accordingly. Gathering data on things such as engagement levels across different channels; conversion rate by channel/region/demographic; average order values (AOV) by channel/region/demographic; customer feedback & reviews; repeat purchase rates among sampled customers; new vs existing customer purchases rates among sampled customers—all these types of information can help brands further optimize their campaigns moving forward.