As we move into 2025, shopper habits are continuing to shift, influenced by economic factors, changing priorities, and evolving preferences. Brands that want to stay competitive must understand these trends and adjust their strategies to attract and retain customers. Based on our latest research, here’s a look at key shopper behavior shifts and how brands can respond.

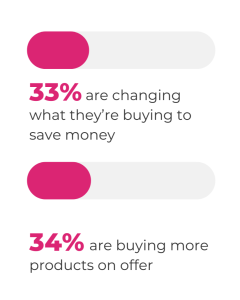

The rising cost of groceries is affecting nearly every shopper. According to our study, 57% of shoppers are spending more on groceries than last year, averaging $154 per week. Despite this, shoppers are still prioritizing health and wellness, seeking out natural and organic products even as they look for ways to save money.

Today’s shoppers are not sticking to a single store. On average, they shop at four different retailers regularly, with 61% choosing conventional retailers like Walmart as their primary store. While natural and organic products were once primarily found in specialty stores, they are now expanding into mainstream retail, and brands need to follow suit.

What this means for brands:

- Expanding into mass retailers can increase visibility and make products more accessible to a broader audience.

- Retail partnerships and promotions in conventional stores can help capture new shoppers.

- Offering affordable versions of hero products for mainstream stores can help balance premium positioning with accessibility.

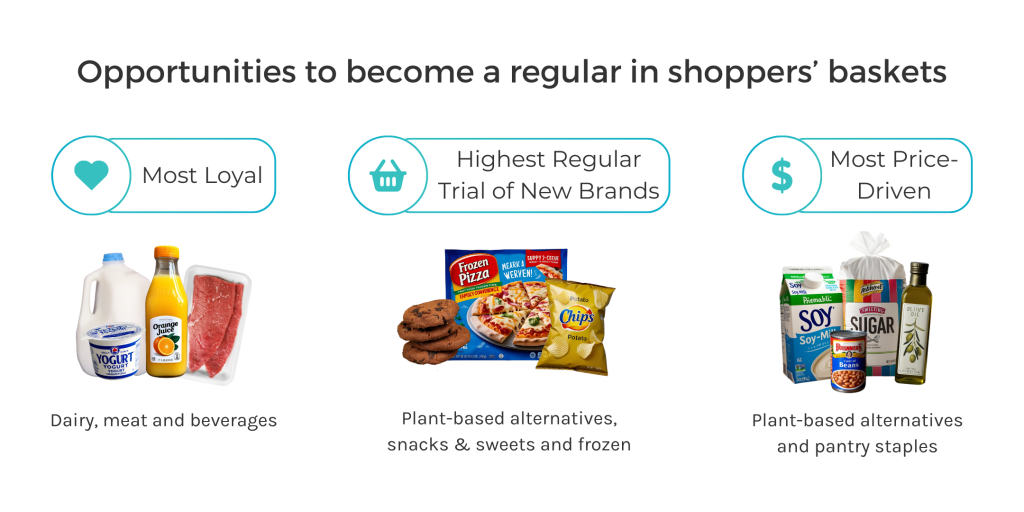

Shoppers today are more open to trying new brands than ever before. Only 6% of shoppers always buy the same brand, while 46% regularly try new brands, and 35% have a few go-to brands but are open to exploring others.

What this means for brands:

- The initial trial is critical – offering free samples or deep discounts can help get your product in front of new customers.

- 50% off was the most effective discount in encouraging trial, while 10% off was not compelling.

- In-store visibility is key – products that stand out on the shelf have a better chance of being discovered.

- Word-of-mouth marketing and product reviews heavily influence purchasing decisions, so leveraging brand advocates can be a powerful strategy.

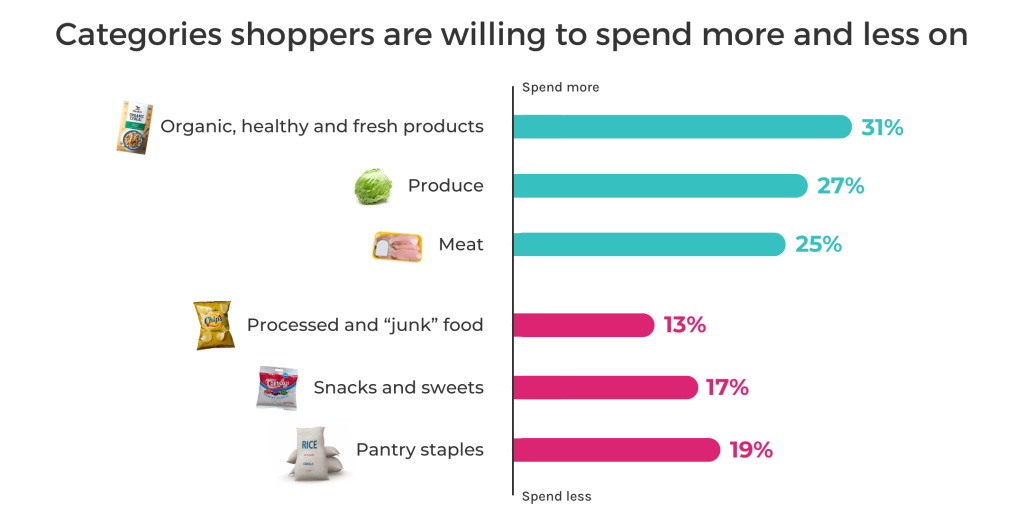

While shoppers are cutting back in some areas, they are still spending more on fresh, healthy, and high-quality products. Categories like organic, high-protein, and low-sugar foods are growing in popularity, while processed snacks, pantry staples, and household items are areas where shoppers are trying to spend less.

What this means for brands:

- Highlight product attributes that matter to shoppers, such as clean ingredients, protein content, and no added sugar.

- Packaging and messaging should align with shopper health goals.

- Consider premium positioning in categories where shoppers are willing to pay more.

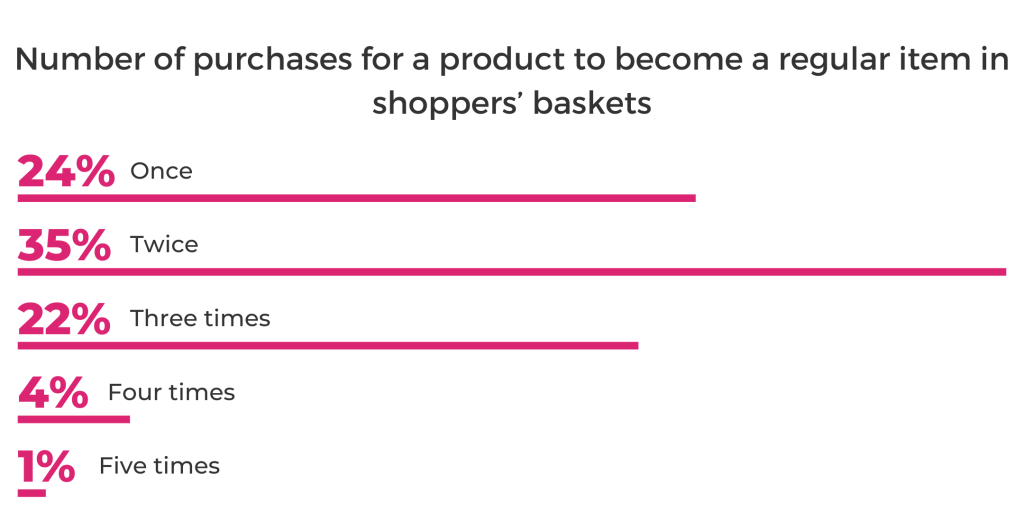

Attracting new customers is just the first step – getting them to repurchase is where long-term growth happens. On average, it takes 2.1 purchases before a product becomes a regular staple in a shopper’s basket. The top reasons shoppers keep buying a brand include:

- Taste

- Quality

- Ingredients

- Value for money

What this means for brands:

- Ensure a great first experience by perfecting flavor, texture, and overall product quality.

- Reinforce messaging around clean, high-quality ingredients.

- Use retargeting strategies to bring back first-time buyers.

- Connect to aspirational health goals – many shoppers buy products that align with their wellness journey.

Understanding these shopper trends can help brands develop stronger marketing and product strategies. Here are a few ways to take action:

- Offer targeted discounts to encourage first-time purchases.

- Use shopper insights and trial data to help expand into conventional retailers to increase reach.

- Use clear packaging and messaging to highlight key product attributes.

- Leverage word-of-mouth marketing, including reviews and social proof.

- Implement retention strategies, like retargeting buyers with additional offers, to keep customers coming back.

Want to dive deeper into these insights? Download our full study on ‘How to Attract and Retail Shoppers in 2025’ to get more insights and recommendations for your brand.