As you assess your retail growth strategy for 2025, it’s crucial that your spend has a direct impact on solving the right problems. We’ll delve into how best to navigate these shopper marketing complexities with four simple questions you need to ask yourself here:

Table of Contents

When it comes to retail growth, one of the fundamental considerations is whether to focus on growing your current shelf space or expanding into new retail accounts. This decision often boils down to a choice between velocity and all commodity volume (ACV). Velocity refers to the rate at which products are sold, while ACV measures the presence of a product in retail outlets.

We believe emerging CPG brands should place a greater focus on velocity, at least early on, to defend their position on shelf. As stated by Lauren Ivison, a Partner with Ridgeline Ventures:

“When evaluating a brand, velocity holds more weight than ACV for us. We would rather see a company that has built a strong and growing tribe of devoted customers than one with low velocity that has placement in a lot of stores. If a company’s product isn’t moving off the shelf, a higher store count won’t compensate for a brand that isn’t selling.”

One of Social Nature’s unique differentiators in the digital sampling space is our ability to focus targeted trials against a brand’s key account store list. With our digital product sampling, we can drive high-intent shoppers into 500+ retailers and get them to try your products.

Our advice would be to zero in on retailers where you have the most to gain or lose. Did you just gain distribution at some Walmart and Targets as a test, and depending on your velocity performance, could gain additional doors? Or does your buyer have velocity expectations to maintain your position on shelf? These scenarios are perfect opportunities to co-create a sampling program together and support specific retailers where you have the most to gain.

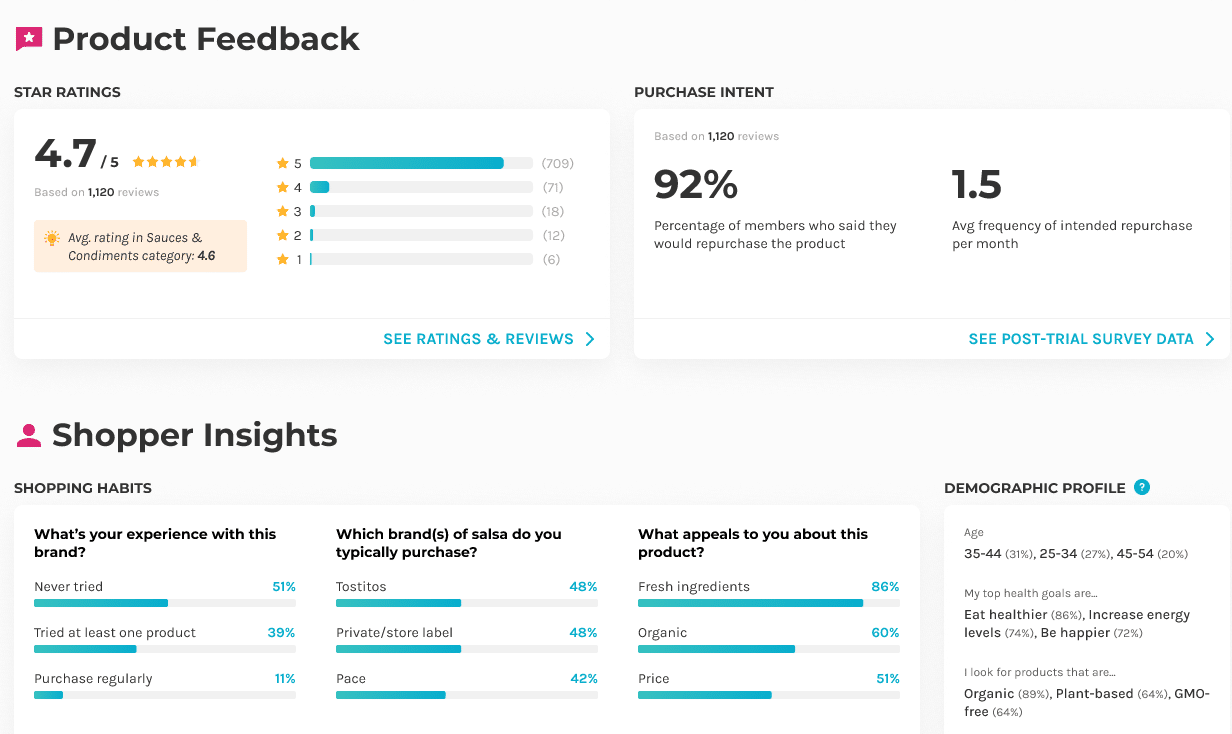

Buyer review meetings are crucial opportunities to win and defend shelf space, so don’t miss the opportunity to bring insights to the table to derisk a buyer’s investment in you as a brand. Buyers are interested in information that validates your price, position and product. Through your Social Nature campaign, you can take it one step further and also illustrate demand for your product, purchase intent and growth to your category thereafter. Show retailers how you’ll generate consumer demand for your product launch and that you’ll support that demand with trial and repeat purchase by working with Social Nature.

Read more about leveraging shopper insights in buyer meetings in our Sweet Nothings case study; see how this emerging brand used shopper data from a product launch at Sprouts to win a new listing at Walmart.

One-size-fits-all sampling solutions often fall short when it comes to defending a brand’s position on shelf.

Since we know that hyper-targeted trial is the ultimate path to purchase, brands need a shopper marketing solution that understands their unique audience. Many sampling platforms tout their community of engaged customers, but their definition of “community” can vary significantly and often these platforms require you to leverage your own digital marketing efforts to acquire new customers, and therefore merely serve as a rebate processor.

With Social Nature, our community of +1.1 million on demand shoppers answer over 50 questions about themselves, their shopping habits, health goals, etc. when they sign up to our platform. Then, in order to qualify for a brand’s offer, community members also need to self-select into campaigns and answer the brand’s custom pre-trial survey. This pull-through strategy, as opposed to your typical pushy sampling approach, creates an effective funnel that drives high-intent shoppers into the aisle to try your products.

We’re here to help, even if it’s just for a 30 minute consult to understand your pain points so that we can make some recommendations on how best to approach.